change in operating working capital formula

If the price per unit of the product is 1000 and the cost per unit in inventory is 600 then the companys working capital will increase by. Capital Expenditure CAPEX.

/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)

Working Capital Formula Components And Limitations

Changes in Net Working Capital Working Capital Current Year Working Capital Previous Year Or.

. Current Assets and Current Liabilities. So if we use relative change formula revenue has increased by 10 100 10 but cost has been increased by 10 80 125. More Current Ratio Explained With Formula and Examples.

Operating Activities includes cash received from Sales cash expenses paid for direct costs as well as payment is done for funding working capital. Working capital or net working capital NWC is a measure of a companys liquidity operational efficiency and short-term financial health. Department of Defense has listed climate change as a national security threat and is now taking steps to reduce its carbon footprint.

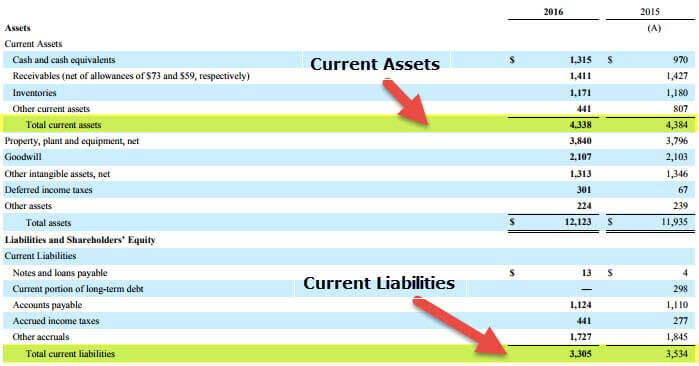

Net Working capital in very simple terms is basically the amount of fund which a business needed to run its operations on a daily basis. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Typical current assets that are included in the net working capital calculation are cash accounts receivable inventory and short-term investmentsThe current liabilities section typically includes accounts payable accrued expenses and taxes customer deposits and other trade debt.

You need to provide the two inputs ie. Current liabilities are best paid with current assets like cash cash equivalents and. As of October 3 2017 the company had 218 million in current assets and 384 million in current liabilities for a negative working capital balance of -166 million.

What is Change in NWC. Current Ratio and Quick Ratio. A company can increase its working capital by selling more of its products.

The simple formula above can be built on to include many different items that are added back to net income such as depreciation and amortization as well as an increase in accounts receivable inventory and. Adequate Net Working Capital ensures that your business has a smooth operating cycle. Operating Cash Flow OCF is the amount of cash generated by the regular operating activities of a business within a specific time period.

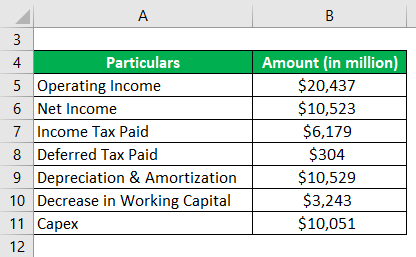

Net working capital 7793 Cr Based on the above calculation the Net working capital of Colgate Palmolive India is positive which indicates that the short-term liquidity position of the company is positive. How to Calculate It with the Income Statement For a fundamental investor anticipating revisions in expectations is the key to generating attractive returns. Capital expenditure or CapEx are funds used by a company to acquire upgrade and maintain physical assets such as property industrial buildings or equipment.

Therefore Microsofts TTM owner earnings come out to be. Leverage our proprietary and industry-renowned methodology to develop and refine your strategy strengthen your teams and win new business. Change in Net Working Capital Formula Calculator.

You can easily calculate the Working Capital using the Formula in the template provided. The simple operating cash flow formula is. Get 247 customer support help when you place a homework help service order with us.

The Change in Net Working Capital NWC section of the cash flow statement tracks the net change in operating assets and operating liabilities across a specified period. Below is an example balance sheet used to calculate working capital. What is Working Capital.

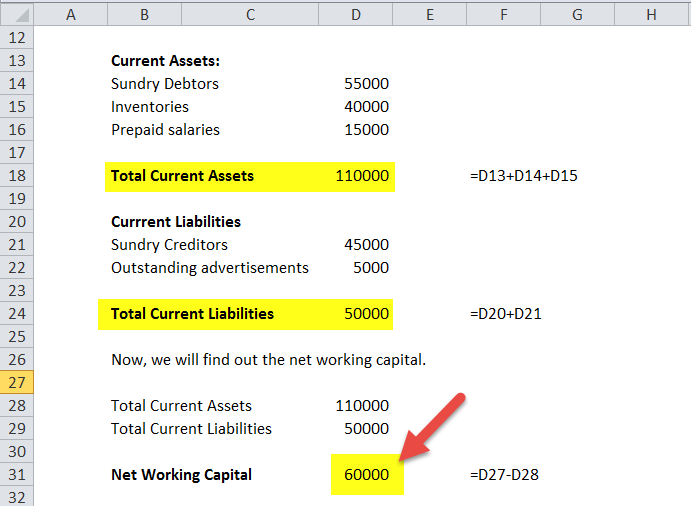

Army was first to unveil a sweeping climate. Net Working Capital Formula Current Assets Current Liabilities. We offer free revision as long as the client does not change the instructions that had been previously given.

ABB is a pioneering technology leader that works closely with utility industry transportation and infrastructure customers to write the future of industrial digitalization and realize value. Working Capital Formula in Excel With Excel Template Here we will do the same example of the Working Capital formula in Excel. If the change in working capital is positive the company can grow with less capital because it is delaying payments or getting the money upfront.

Example calculation with the working capital formula. As a working capital example heres the balance sheet of Noodles Company a fast-casual restaurant chain. It comprises inventory cash.

In a capital lease the part of lease payment considered payment on principal reduces cash flow from financing activities Cash Flow From Financing Activities Cash. Net Working Capital Total Current Assets Total Current Liabilities. Also remember to state the exact time the writer should take to do your revision.

Net working capital 106072 98279. Change in Net. This means the time needed to acquire raw material manufacture goods and sell finished goods is optimum.

Intuitively DOL represents the risk faced by a company as a result of its percentage split between fixed and variable costs so the formula is measuring the sensitivity of a companys. Since the change in working capital is positive you add it back to Free Cash Flow. In practice the formula most often used to calculate operating leverage tends to be dividing the change in operating income by the change in revenue.

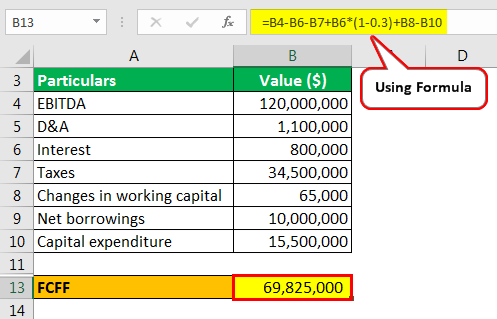

Operating Cash Flow Net Income All Non-Cash Expenses Net Increase in Working Capital. For such an order you are expected to send a revision request and include all the instructions that should be followed by the writer. The working capital ratio also called the current ratio is a liquidity ratio that measures a firms ability to pay off its current liabilities with current assets.

Read more in an operating lease. Working capital is a measure of both a companys efficiency and its short-term financial health. If the change in NWC is positive the company collects and holds onto cash earlier.

Change in Net Working Capital Formula. It is very easy and simple. Change in a Net Working Capital Change in Current Assets Current Assets Current assets refer to those short-term assets which can be efficiently utilized for business operations sold for immediate cash or liquidated within a year.

The working capital ratio is important to creditors because it shows the liquidity of the company. However if the change in NWC is negative the business model of the company might require. In other words it is the measure of liquidity of business and its ability to meet short term expenses.

OCF begins with net income from the bottom of the income statement adds back any non-cash items and adjusts for changes in net working capital to arrive at the total cash generated or consumed in the. Working capital is calculated as. Some people also choice to include the current portion of long-term debt in the liabilities section.

So this will impact the profit of the company and they can dig deep and understand why the cost is increasing and can take corrective action to curb the cost. Changes in the Net Working Capital Change in. Because the change in working capital is positive it should increase FCF because it means working capital has decreased and that delays the use of cash.

18819105991263-13102 19192 34245.

Operating Working Capital Owc Formula And Calculator Excel Template

Working Capital Formula And Calculation Example Excel Template

Cash Flow Formula How To Calculate Cash Flow With Examples

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

Change In Net Working Capital Nwc Formula And Calculator Excel Template

Cash Flow Formula How To Calculate Cash Flow With Examples

Free Cash Flow To Firm Fcff Formulas Definition Example

Working Capital Cycle Efinancemanagement

Net Working Capital Definition Formula How To Calculate

How To Calculate Fcfe From Ebit Overview Formula Example

Working Capital Formula And Calculation Example Excel Template

Changes In Net Working Capital All You Need To Know

:max_bytes(150000):strip_icc()/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)

Working Capital Formula Components And Limitations

Change In Net Working Capital Nwc Formula And Calculator Excel Template

Negative Working Capital Causes And Cash Flow Impact Excel Template

Working Capital Formula And Calculation Example Excel Template

Working Capital Formula And Calculation Example Excel Template